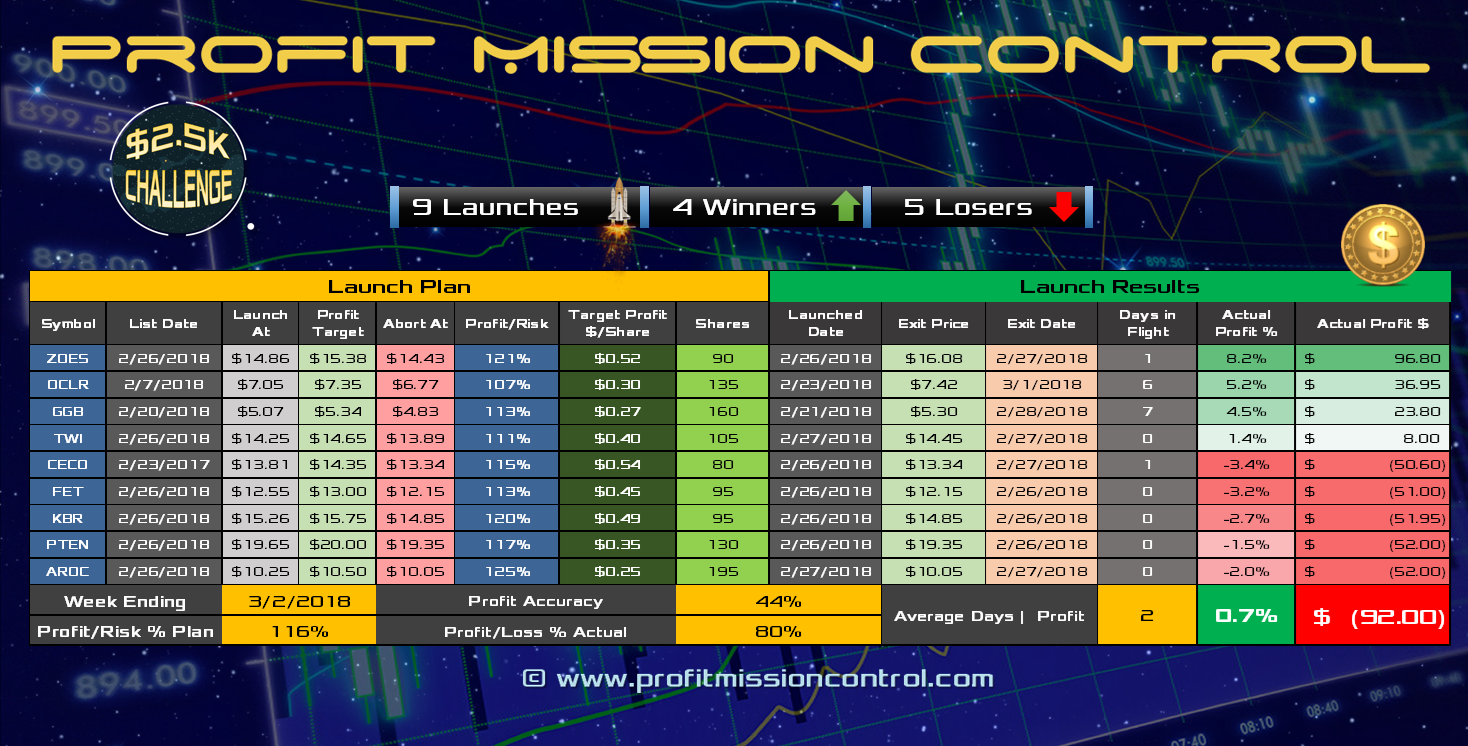

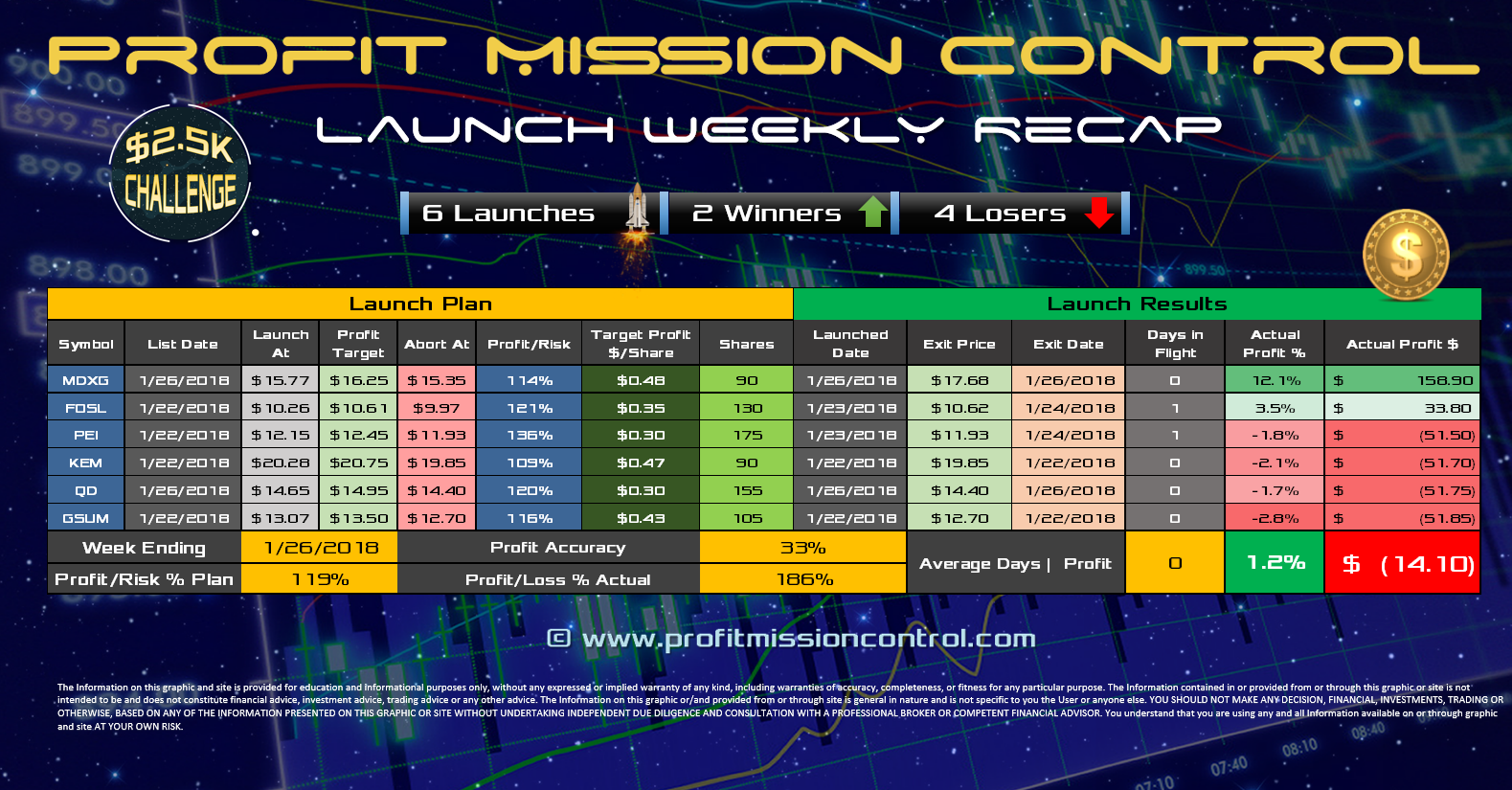

Profit Recap for the Week of March 9th, 2018

This was by far the best trading week for the launch list since the start of the year and the start of the $2.5K challenge on Dec 8th of 2017. Despite a choppy start of the week due to the resignation of the white house's economic advisor the market pulled through as tensions on the Korean Peninsula seemed to have been temporarily cooling off.

We published multiple launch lists this week and ended up with great accuracy.