| Profit Recap for Week Ending |

Saturday, September 16, 2017

|

|---|

This was a very challenging yet rewarding week with the market staging a another push to all time highs. The momentum on small cap stocks seem to be picking up as evidenced from multiple 100%+ winners this week in the market. We haven't seen such major moves on any stocks in the last few months, so there are signals that the end of the year momentum is creeping in.

Technically the market is still pushing upward and is in a confirmed uptrend until it is not. We continued to publish Launch Lists with a long bias this week with three lists on Monday, Wednesday and Friday. The challenge was that there were so many lunches, and this may have been a record week in terms of the number of launches with 22 blasting off. The profits were great and the accuracy remains solid.

Just as last week, some of the stocks on the loosing side staged another comeback above the initial launch price. This was after the abort price price was realized. Once these stocks hit the launch price again, they blasted through the profit target. Despite how annoying this may seem, proper risk management and sticking with the rules is always better in the long run. In the case of $XXII I made another entry and managed to lock in profits on the second launch. Similarly I decided to take another stab at $TEN and the stock now is in flight above the launch price after taking a hit.

Another disappointment was $BEDU which gapped up premarket beyond the Launch price of $20.50 opening at $20.90 area. I couldn't find a good entry for this intraday as several other stocks were launching at the same time so had to pass on this opportunity.

Overall, the launch lists rewarded the portfolio with several great winners. There were many intrady launches that I alerted to on StockTwits. Especially on Friday, I was on really tuned in with the market and several of my calls made amazing profits.

This week profits were launched on $SVRA $XXII $AMRS $MRTX $STRL $IDTI $DO $TRUP $MACK $XOMA $AAL $BL $HEP $GOLF. Loss on $LIVN $GIS $TEN $AMAG $CONN $MTEM $TISI $XXII . Accuracy at 64% and Average Profit Per Trade at 4%. I hope that you made some nice profits with some of these ideas.

This is cumulative portfolio growth chart that captures the profit on a weekly basis from the year's start trading 2500 shares per trade. This chart only contains the trades that are launched based on the Launch List published on the site. The profit growth does not include intraday day calls from our intraday alerts. Lots of people ask me if this is real or not. I don’t understand why does this matter. The portfolio growth is based on actual entries and exits from the Launch List that are published on the site, StockTiwts, Twitter and Facebook. Our actual portfolio varies in large because of other trades that are taken intraday. If it makes you feel better that this is based on simulated trades that is okay. Our goal is not to brag about profits whether they are real or not, our goal is to track a winning system that generates profits based on Launch transparent plans that are published 2-5 times a week.

For this week, the portfolio added another $21,325 reaching a total sum of $341,383.

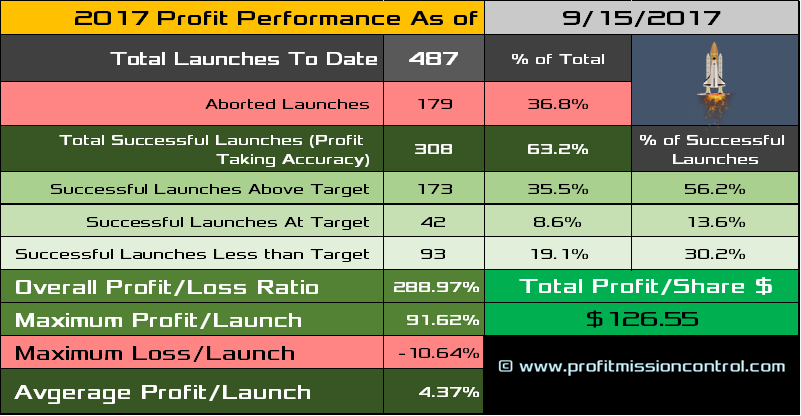

Here is the latest update to the Launch List Performance Card. To date 487 Launches, 63.2% Accuracy with an average Profit/Launch of 4.37%. On a per share basis for the year to date the Profit per Share $126.55. If you multiply that Profit Per Share times the number of shares per trade, that will give you the total profit per year. For example if you take 500 shares per trade, the total profit this year would be 500 X $126.65 = $63,325.